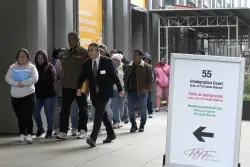

Student loans in default will be sent for collection. Here’s what to know for borrowers

By ADRIANA MORGA NEW YORK AP Starting next month the Teaching Department says trainee loans that are in default will be referred for collections Roughly million borrowers are in default on their federal participant loans and soon could be subject to having their wages garnished Referrals for collection had been put on hold since March because of the COVID- pandemic when the U S establishment also paused federal learner loan payments and interest accrual as a temporary relief measure That grace period was extended multiple times by the Biden administration and ended in October The department says it will soon begin sending notices on collection efforts but there are options for borrowers to get out of default Here are certain key things to know How will involuntary collection work Beginning May the department will begin involuntary collection through the Treasury Department s offset undertaking Borrowers who have learner loans in default will receive communication from Federal Apprentice Aid in the upcoming weeks with information about their options according to the Learning Department Involuntary collection means the governing body can garnish wages intercept tax refunds and seize portions of Social Prevention checks and other benefit payments to go toward paying back the loan What is the difference between delinquent and default in my participant loans A learner loan becomes delinquent when a borrower doesn t make a payment days after its due date If you continue to be delinquent on your loan for days or roughly nine months then your loan goes into default Related Articles Harvard sues Trump administration to stop the freeze of more than billion in grants Pupil loans in default to be referred to debt collection Schooling Department says Sleep training is no longer just for babies Particular schools are teaching teens how to sleep Lawsuit challenges revocation of visas for international students Wisconsin governor can lock in -year school funding increase using a veto court says While being delinquent affects your credit figure going into default has more serious consequences such as wage garnishment What happens when a loan goes into default When you fall behind on a loan by days the loan appears on your credit document as being in default Once a loan is in default the cabinet will send the borrower into collections What can I do right now if my learner loan is in default The Teaching Department is recommending borrowers visit its Default Resolution Group to make a monthly payment enroll in an income-driven repayment plan or sign up for loan rehabilitation Betsy Mayotte president of The Institute for Apprentice Loan Advisors recommends loan rehabilitation as an option Borrowers in default must ask their loan servicer to be placed into such a venture Typically servicers ask for proof of income and expenses to calculate a payment amount Once a borrower has paid on time for nine months in a row they are taken out of default Mayotte stated A loan rehabilitation can only be done once What does forbearance mean Novice loan forbearance is a temporary pause on your novice loan payments granted to borrowers who are experiencing financial difficulties To apply for forbearance borrowers must contact their loan servicer Borrowers can be granted forbearance by their loan servicer for up to months but interest will continue to accrue during this period The Associated Press receives advocacy from Charles Schwab Foundation for educational and explanatory reporting to improve financial literacy The independent foundation is separate from Charles Schwab and Co Inc The AP is solely responsible for its journalism